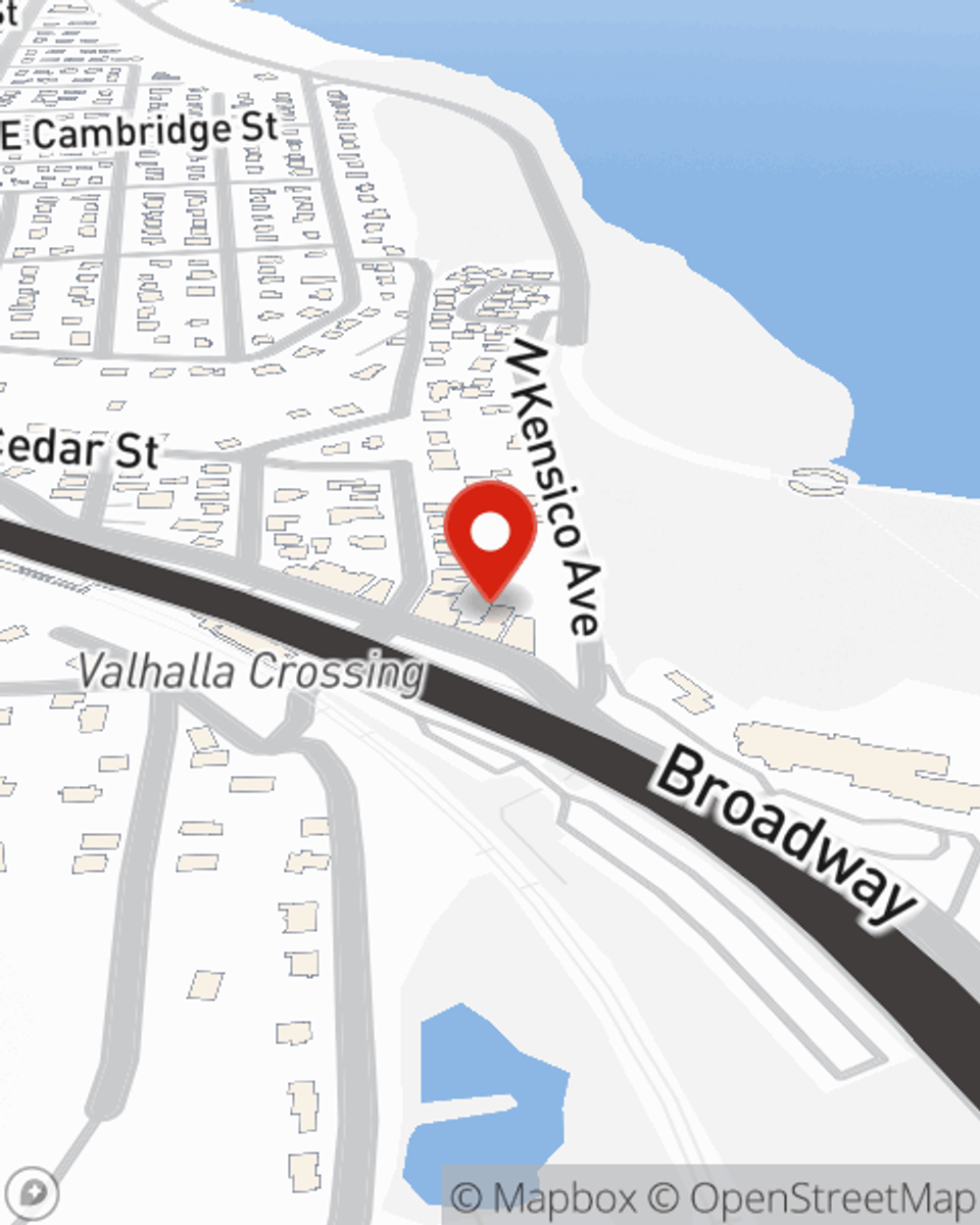

Business Insurance in and around Valhalla

One of Valhalla’s top choices for small business insurance.

Helping insure small businesses since 1935

- Manhattan

- The Bronx

- Queens

This Coverage Is Worth It.

Small business owners like you have a lot on your plate. From tech support to HR supervisor, you do everything you can each day to make your business a success. Are you a real estate agent, a pharmacist or an insurance agent? Do you own a photography business, a dance school or a vet hospital? Whatever you do, State Farm may have small business insurance to cover it.

One of Valhalla’s top choices for small business insurance.

Helping insure small businesses since 1935

Small Business Insurance You Can Count On

You are dedicated to your small business like State Farm is dedicated to outstanding insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, business owners policies or commercial auto.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Marc Tedaldi's team to identify the options specifically available to you!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Marc Tedaldi

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.